nc state sales tax on food

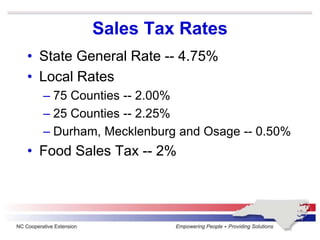

Counties and cities in North Carolina are allowed to charge an additional. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

States Without Sales Tax Article

Rates include state county and city taxes.

. The exemption only applies to sales tax on food purchases. Total General State Local and Transit Rates Tax Rates Effective 1012020 Historical Total General State. NC State is not exempt from the prepared food and beverage taxes administered by local counties and.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Gross receipts derived from sales of food non-qualifying food and prepaid meal plans and the applicable sales and use tax thereon are to be reported to the Department. 7 Sales and Use Tax Chart.

Prescription Drugs are exempt from the North Carolina sales tax. Showing 1 to 6 of 6 entries. 2020 rates included for use while preparing your income tax deduction.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in. The latest sales tax rates for cities in North Carolina NC state. Arkansas Grocery items are not tax exempt but food and food ingredients are taxed at a reduced Arkansas state rate of 15 any.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. North Carolina State Sales Tax. A bundled transaction that includes a prepaid meal plan is taxable in accordance with NC.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. The tax amount is a mathematical computation of the. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. This page describes the taxability of. North Carolina charges sales tax on 50 percent of the cost of a modular or manufactured home including skirting gutters siding upgrades and other accessories attached when delivered.

Appointments are recommended and walk-ins are first. 2 Food Sales and Use Tax Chart. Maximum Local Sales Tax.

A customer buys a toothbrush a bag of candy and a loaf of bread. Average Local State Sales Tax. State Sales Tax.

725 Sales and Use Tax Chart. Prescription Drugs are exempt from the North Carolina sales tax. North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax.

According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7. 75 Sales and Use Tax Chart. Arizona grocery items are tax exempt.

Historical Total General State Local and Transit Sales and. The general State and applicable local and transit rates of sales and use tax apply to the sales price of each article of tangible personal property that is not subject to tax under another. 35 rows Sales and Use Tax Rates Effective October 1 2020 Skip to main content.

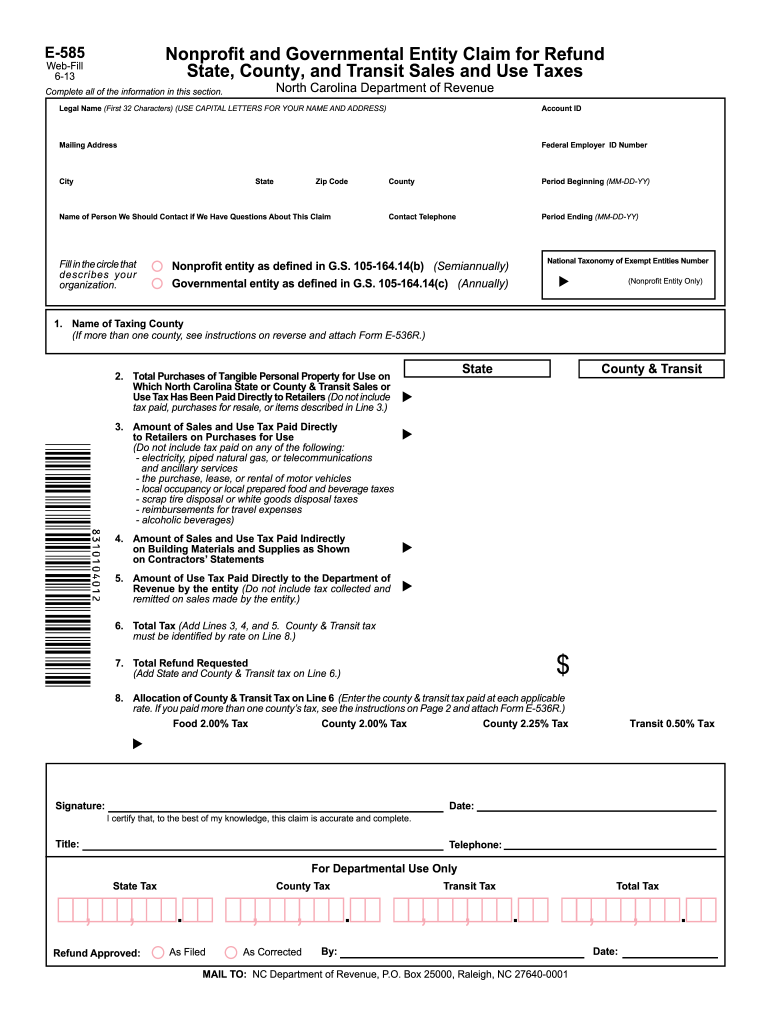

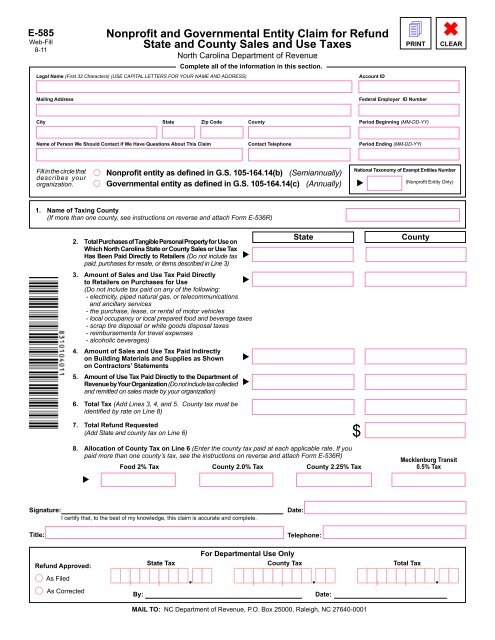

Maximum Possible Sales Tax. This tax chart is provided for the convenience of the retailer in computing the applicable sales and use tax of Food.

These Are Other States With Tax Breaks On Diapers And Menstrual Products Fortune

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Easley Michael Press Release 2008 07 25 Gov Easley Announces More Savings Offered At N C Sales Tax Holiday Consumers Can Save Even More This Year On Back To School Needs Clothing And Computers Governors Papers

Sales Tax Laws By State Ultimate Guide For Business Owners

Ohio Sales Tax For Restaurants Sales Tax Helper

New York City Sales Tax Rate And Calculator 2021 Wise

A Monthlong Sales Tax Holiday On Groceries In Tennessee Business Johnsoncitypress Com

North Carolina Sales Tax Update

Form Nc Department Of Revenue Fill Out Sign Online Dochub

Nc Sales Tax Agcare Products Tm

E585 Revised 12 03 Nc Department Of Revenue

North Carolina Sales Tax Small Business Guide Truic

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How Are Groceries Candy And Soda Taxed In Your State

Both Leading Candidates For Kansas Governor Want To Cut The Sales Tax On Food Kansas Public Radio

Understanding California S Sales Tax

Taxes On Food And Groceries Community Tax